White House Moves to Shield U.S. Corporations from Global Tax Overreach

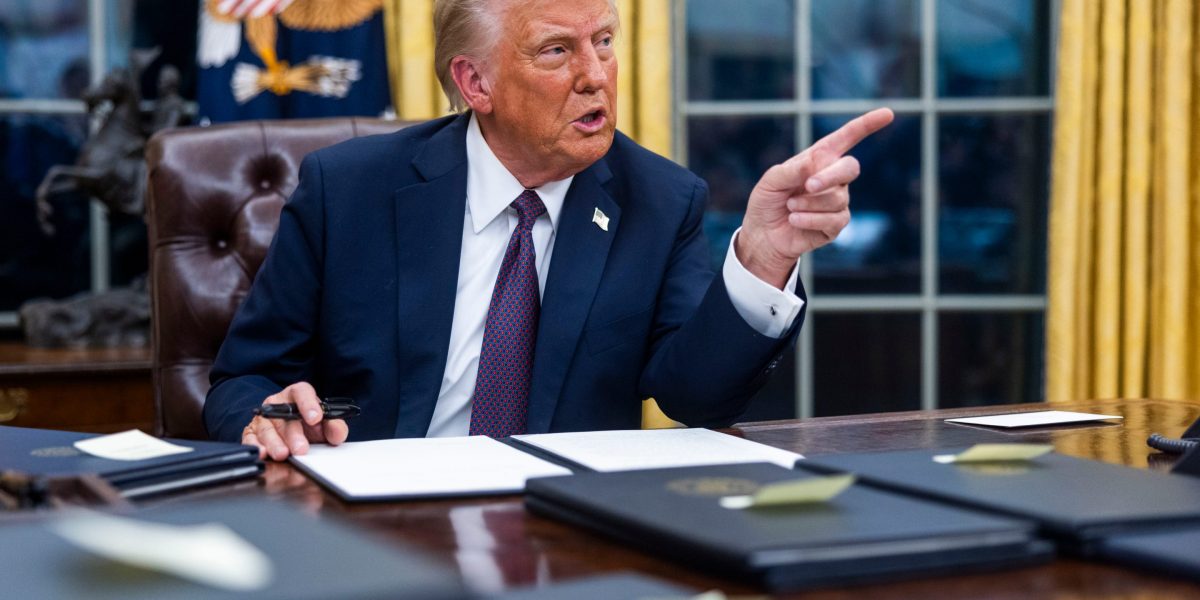

In a bold move that challenges international tax cooperation, President Donald Trump has effectively nullified a previously negotiated global tax agreement. Through an official memorandum, Trump declared that the international tax deal would have "no force or effect" within the United States, signaling a unilateral rejection of the multinational consensus.

The presidential statement underscores the administration's stance of prioritizing national economic interests over global tax harmonization efforts. By dismissing the agreement, Trump has sent a clear message about the United States' independent approach to international fiscal policy, potentially disrupting ongoing negotiations and collaborative tax frameworks.

This decisive action highlights the complex dynamics of global economic diplomacy and the Trump administration's willingness to diverge from internationally established norms. The memorandum not only invalidates the existing tax agreement but also reflects a broader strategy of asserting American sovereignty in economic matters.