Tariff Tsunami: Manufacturing Costs Surge in February Amid Global Trade Tensions

Manufacturing Costs Surge: Prices Climb to Highest Point in Eight Months

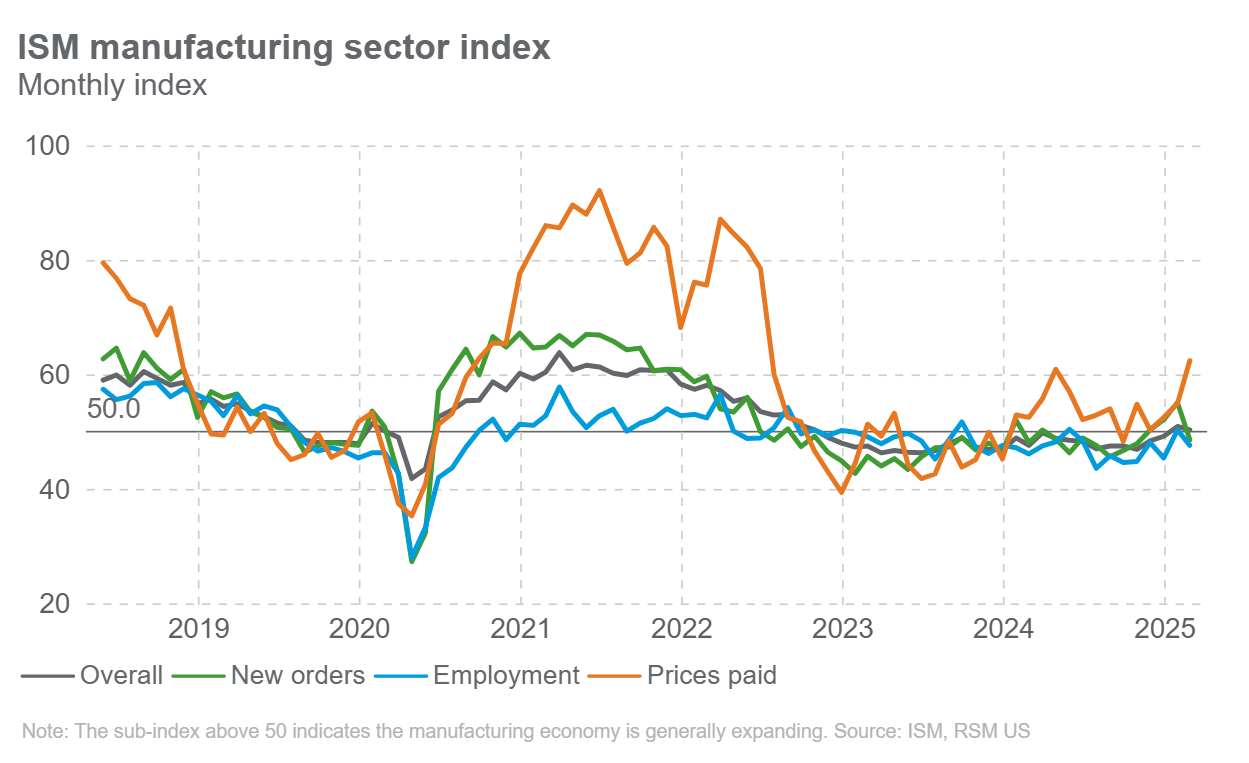

The latest ISM manufacturing report reveals a significant uptick in input prices, signaling potential inflationary pressures in the industrial sector. The prices paid subindex jumped to 62.4 in February, marking its highest level since last June and representing a substantial increase from January's reading of 54.9.

This sharp rise suggests that manufacturers are experiencing increased costs across their supply chains, which could potentially translate into higher prices for consumers. The substantial month-over-month increase indicates growing economic momentum and potential challenges in managing input expenses for industrial businesses.

Economists and market analysts will be closely watching this indicator as it provides crucial insights into manufacturing cost trends and potential inflationary signals in the broader economy.