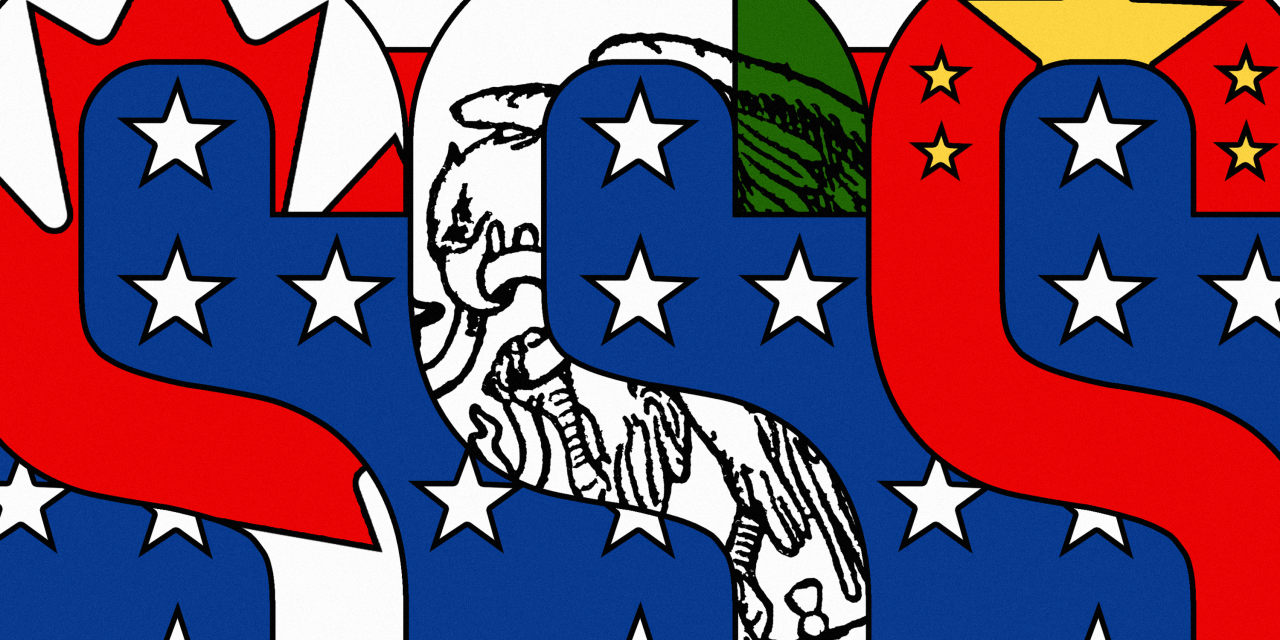

Sole Survivors: American Footwear Giants Prepare for China Tariff Showdown

The U.S. footwear industry braces for potential economic turbulence as new tariffs threaten to disrupt shoe imports from China. With China dominating the American shoe market, supplying an impressive 58% of all footwear imports, the potential impact could be significant for U.S. shoe companies and consumers alike.

According to the Footwear Distributors and Retailers of America, China currently provides approximately 1.24 billion pairs of shoes to the United States annually. These proposed tariffs could dramatically increase production costs, potentially forcing shoe manufacturers to either absorb the additional expenses or pass them on to consumers through higher retail prices.

The looming trade restrictions highlight the complex relationship between U.S. importers and Chinese manufacturers, underscoring the critical role of international trade in the footwear industry. As companies scramble to assess the potential economic implications, many are exploring alternative manufacturing strategies and supply chain diversification to mitigate potential financial risks.

Consumers and industry experts are closely watching how these tariffs might reshape the shoe market, potentially triggering a significant transformation in how and where footwear is produced and distributed.