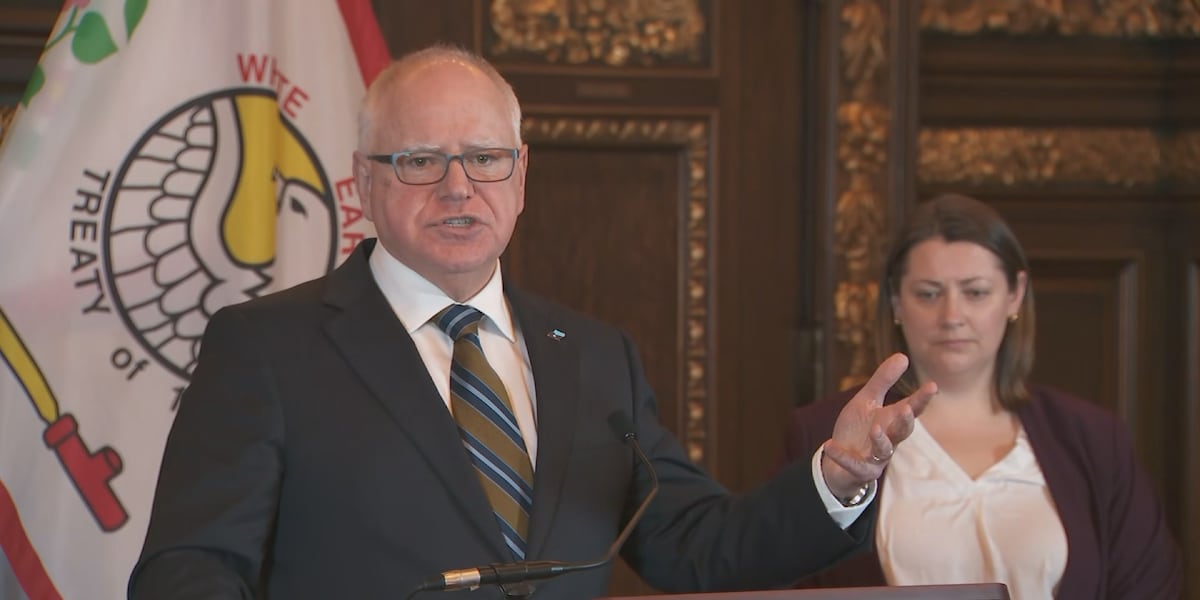

Healthcare Cost Crackdown: Walz Challenges Insurers to Step Up

In a bold move to reshape Minnesota's healthcare landscape, Governor Tim Walz is proposing a significant policy shift for the state's reinsurance program. The governor is challenging insurance companies to contribute what he describes as their fair share, aiming to create a more balanced and equitable healthcare funding model.

Walz's proposal seeks to restructure the current reinsurance system by asking insurance providers to step up their financial contributions. By doing so, he hopes to stabilize insurance costs and improve healthcare accessibility for Minnesota residents. The initiative reflects a commitment to addressing rising healthcare expenses and ensuring that the financial burden is more evenly distributed across the industry.

The governor's push for a more equitable approach signals a potential transformation in how reinsurance programs are funded and managed in the state. Insurance companies will likely face increased scrutiny and pressure to align with the administration's vision of a more transparent and fair healthcare funding mechanism.