Crypto ATM Crackdown: Iowa AG Launches Legal Assault on Digital Currency Machines

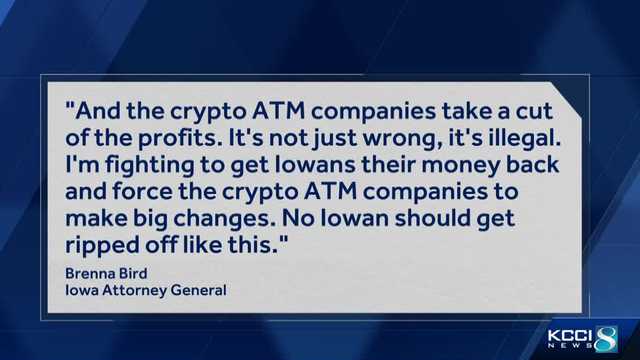

The cryptocurrency ATM industry is facing legal heat as two major players, Bitcoin Depot and CoinFlip, find themselves at the center of recent lawsuits that could reshape the digital currency exchange landscape.

These legal challenges highlight growing scrutiny of cryptocurrency transaction platforms and their operational practices. The lawsuits allege potential irregularities in how these Bitcoin ATM providers conduct their business, signaling increased regulatory attention to the rapidly evolving crypto infrastructure.

Bitcoin Depot and CoinFlip, both prominent names in the cryptocurrency ATM market, are now confronting legal allegations that could have significant implications for their business models and the broader digital currency ecosystem. While specific details of the lawsuits remain emerging, they underscore the complex legal environment surrounding cryptocurrency transactions.

As the crypto industry continues to mature, such legal actions represent an important mechanism for ensuring transparency, consumer protection, and accountability in a sector known for its innovative but sometimes opaque practices.

Investors, cryptocurrency enthusiasts, and industry observers are closely watching these developments, recognizing that the outcomes could potentially set important precedents for how cryptocurrency ATM services operate in the future.